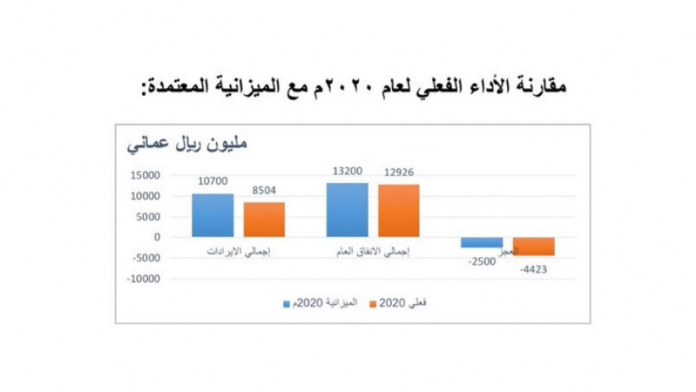

The State Budget’s closing account, issued by the Ministry of Finance, shows that actual revenues received during 2020 stood at RO8,503.2 million, less by RO2,196.8 million or 20.5 per cent short of the approved budget.

The Ministry said in a statement that this decline is due to a 24.7 per cent slump in oil and gas revenues (RO1.902 billion), being the difference between the actual average oil price of US$47.6 per barrel and the approved price of US$58 set for the 2020 Budget.

The actual average oil price achieved in 2020 was US$47.6 per barrel, down by US$10.4, from the price approved for the budget (US$58) as against US$65.24 average oil price achieved during 2019.

The actual rate of oil production stood at 952,700 a day, compared to 970,000 approved for the budget, less by 1.8 per cent.

Actual oil revenues during 2020 stood at RO5,797.7 million, down by RO1,902.3 million from approved budget estimates, or less by 24.7 per cent due to the slump in international oil prices.

Net actual oil revenues in 2020 stood at about RO3,937.5 million, compared to RO6,098.5 million in 2019, down by RO2.161 billion after transfers to the Oil Reserves Fund.

Gas revenues by the end of 2020 stood at RO1,860.2 million, down by RO339.8 million as compared to the allocated budget. This was due to the slump in international oil prices and a decline in gas sales, locally and abroad, from 1.459 trillion thermal units to 1.297 trillion thermal units.

Non-Oil Revenue Outlook

Actual non-oil revenues by the end of 2020 stood at RO2,705.5 million, less by RO294.5 million from approved budget estimates or 9.8 per cent.

The decline is attributed to shrinkage in government services during the period of Covid-19 lockdown and government decisions aimed to ease pressure on private sector companies.

This was coupled with a decline in economic and commercial activities, eventually leading to ‘less fees’ and ‘less taxes’ as approved at the start of the year.

The non-oil revenues include revenues from taxes on companies and establishments, the customs tax, the excise tax levied on certain goods, government investment profits and fees charged against rendered services, in addition to the value of repayments of government loans and capital revenues.

Current revenues constitute 97 per cent of total non-oil revenues, with revenues from taxes and fees by the end of 2020 standing at about RO1,199.2 million (down by 23.8 per cent from approved budget estimates. This is in addition to RO185.7 million revenues from customs taxes achieved last year, short of RO94 million from approved budget estimates. Revenues of the income tax on companies stood at RO468.4 million, down by RO81.6 million.

The revenues of airports and seaports dropped by 48.5 per cent from approved budget estimates due to the exceptional conditions posed by Covid-19 which caused restrictions on travel and aviation activity during 2020. Meanwhile, medical revenues dropped by 66.4 per cent from approved budget estimates.

In turn, the profits of government investments went up by 18.7 per cent from approved budget estimates, an increase of RO37.6 million, with RO237.5 million collected from the profits of government investments in 2020.

Public Spending

Actual public spending in 2020 stood at about RO12,925.7 million, down by RO274 million (or 2.1 per cent) from approved budget allocations.

Current expenditure in 2020 stood at RO9,467.0 million, down by RO363 million, due to precautionary measures set to curb the spread of Covid-19, coupled with a sharp decline in international oil prices, which reflected negatively on public finance.

The actual spending of the defense and security sector dropped by RO615 million or 17.8 per cent from approved budget estimates. The expenditure of civil ministries stood at RO4,588.5 million, exactly equal to approved budget estimates.

Surpluses from a 10 per cent cut to spending allocations of civil ministries were used to meet the exceptional requirements to address Covid-19, notably in the oil, education, and security sectors.

Expenditures on oil production and gas production and procurement rose to RO1,152.0 million, an increase of RO222 million over approved budget estimates. Meanwhile, actual total spending on the public debt service during 2020 stood at RO892 million, up by RO208,000 as against total actual spending in 2019.

Actual total spending for development projects of civil ministries stood at RO71.8 million, down by RO128.2 million as compared to 2020 approved budget figures.

Developmental spending set for the basic structures sector constituted 43 per cent of the total investment spending due to its association with principal segments such as roads, airports, and seaports. The actual spending of the social and service sectors constituted 25.5 per cent from the total developmental spending.

Investment expenditure for oil production went up by 13 per cent, or RO106 million, compared to approved budget estimates. In return, investment spending for the gas sector dropped by RO96 million.

Developmental spending for government firms dropped by 55 per cent from the figures set for the approved budget in 2020 due to rationalization policies espoused by the government in 2020. This is enhanced by the cessation of implementation of new projects or capital spending during the same year.

The actual spending allocated to general contributions in 2020 stood at RO1.005 billion, an increase of RO235 million or 30.5 per cent over approved budget figures. A sum of RO227 million was set aside to cover expenditures of the electricity sector subsidy in 2020 and part of the outstanding of 2019.

The actual deficit by the end of 2020 saw a hike of RO4,422.5 million, up by 77 per cent over the deficit forecast for the 2020 approved budget (RO2.5 billion).

Total funding instruments by the end of 2020 stood at RO4,422.5 million, up by 76.9 per cent over the figure set for the budget (RO2.5 billion). Of this, a sum of RO3,034.7 million was funded through external and domestic loan instruments while a sum of RO500 million was withdrawn from the State’s General Reserve Fund, in addition to the collection of net closing government account of RO1,960.7 million.

Meanwhile, the government met its commitment to repay external and local loans worth RO1,072.9 million in accordance with the agreed settlement plan.