Sohar International has built upon its strengths including customer service, digital-first and people-centricity while chalking up a robust plan for its future growth.

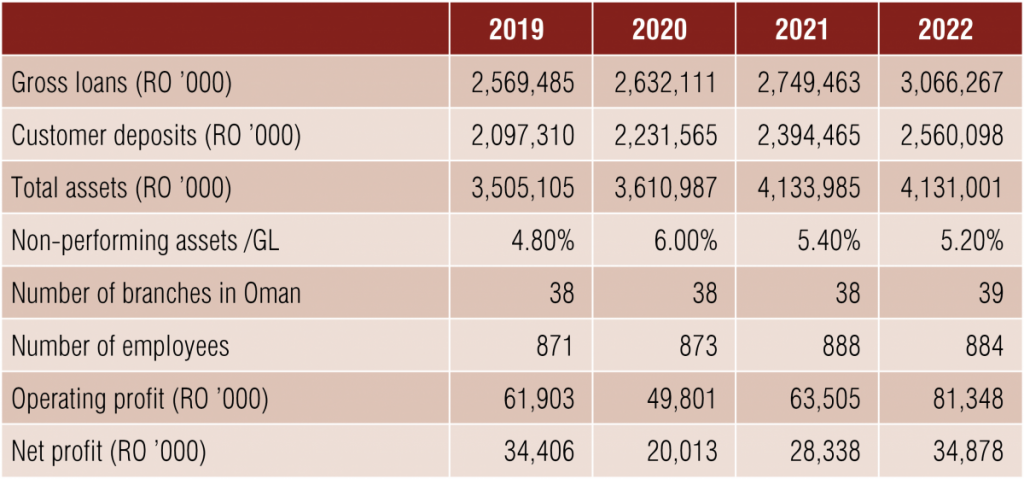

Sohar International continued its impressive performance during the financial year 2022 with all-around robust growth. Profit for the year increased 23.1 per cent to RO34.9mn compared to RO28.3mn in 2021. Total operating income increased by 20 per cent to RO132.9mn compared to RO110.7mn in 2021 driven mainly by an increase in net interest income. Total operating expenses increased 9.8 per cent to RO55.2mn compared to RO50.3mn in 2021 reflecting the bank’s continued investment in people, technology and costs associated with the bank’s strategic initiatives.

Net operating income before impairment provisions increased by 28.6 per cent to RO77.7mn compared to RO60.4mn in 2021 resulting in a total operating expense to total operating income ratio of 41.5 per cent compared to 45.4 per cent in 2021. Net impairment charges and other credit risk provisions for the year were RO39.7mn in 2022 against RO27.1 mn in the previous year demonstrating the bank’s continued prudence in managing its credit risk through the current economic cycle. Total assets as of December 31, 2022, stood at RO4,131mn. Loans, advances and Islamic financing (net) increased by 11.9 per cent to RO2,924 mn on December 31, 2022. reflecting the bank’s continued support of the nation’s economic development.

Customer deposits increased 6.9 per cent to RO2,560mn in 2022 versus RO2,394mn in 2021, highlighting the bank’s strengthening funding & liquidity position. Total shareholders’ equity increased by 42.6 per cent to RO565.5mn after a highly successful rights issue of RO160mn.

Growth strategy

With a healthy diversified balance sheet, improved revenues and profitability and a growing customer base, Sohar International’s organic growth has delivered strong results on the back of digitalisation, innovative solutions and the trust of stakeholders. Sohar International’s agility continues to be an underlying strength in identifying opportunities for growth. In line with the bank’s growth strategy, Sohar International increased its authorised share capital from RO400mn to RO1bn reaffirming the bank’s strengthening market position and shareholder aspirations. The over-subscribed rights issue of RO160mn attests to the bank’s shareholder support, investor confidence and capital-raising ability. The recent announcement by the bank’s Board of Directors approving the entry into a binding merger agreement with HSBC Bank Oman SAOG, under which the two banks agreed to take the necessary steps to implement a merger by incorporation, is an exciting opportunity for the bank to expand its horizons, and a catalyst for socioeconomic growth. The merger, which is still subject to approval from relevant regulatory bodies as well as from the respective shareholders of the two entities, is expected to complete in the second half of 2023. On June 16, 2022, the bank confirmed its commitment to pursue a possible merger with Bank Nizwa SAOG with the due diligence process to be finalised at the earliest. Sohar International has successfully registered a branch in the Kingdom of Saudi Arabia which will be fully operational in 2023. This initiative further increases the bank’s ability to support economic cooperation between Oman and Saudi Arabia to realise meaningful commercial and investment exchanges and contribute towards achieving the goals outlined in Oman Vision 2040.

Creating investor value

Sohar International is dedicated to fostering a robust, stable, and efficient investment ecosystem that brings value to the bank’s partners and investors, thereby supporting the country’s economic growth. The bank has played an instrumental role in attracting global investors through strategic participation in events such as the MSX Investor Roadshow. Similarly, as the lead and fund manager of the Pearl REIF (Real Estate Investment Fund), investors had an opportunity to invest in large-scale income-producing real estate raising over RO50mn. The success of the Initial Public Offering attests to the bank’s overall capabilities to provide financial advisory and handle large complex transactions.

Contributing to economic goals, Sohar International, including our Islamic window (Sohar Islamic), were selected finance partner for Sanvira Carbon FZC LLC (SCL). The project, apart from enhancing the economic landscape and bolstering the manufacturing sector, will enhance in-country value, fortify value chains, generate job opportunities and contribute to the bank’s Environmental, Social and Governance (ESG) agenda. Keeping pace with the increased global focus on embracing ESG, Sohar International also participated at the Green Hydrogen Summit signing a memorandum of understanding with Fortescue Future Industries (FFI), a global leader in developing green energy and renewable energy projects across the world. Sohar International, apart from facilitating FFI’s entry to the Omani market, will arrange the required equity, debt, or syndication financing for projects that meet FFI’s investment criteria.

Redefining with digital

By integrating the latest advancements and trends in technology, Sohar International has ensured that its existing digital platforms are constantly enhanced, and new ones are introduced to provide a better experience to customers. The new Unified Transaction Banking Platform for wholesale banking clients has received an overwhelming response through its effective Cash Management (DigiCash) and Trade Finance (DigiTrade) solutions that empower clients to better manage their day-to-day operations with a paperless approach.

Complementing the lifestyles of customers, the Sohar International and Sohar Islamic applications have been geared with an extensive range of new features including purchase and inquiry of insurance products, additional savings account opening, a monthly planner allowing one-tap bill payment functionality, and the ability to control card limits.

Serving customers

Expanding its ecosystem of products and services through analytic research and an insight-based customer segmentation approach, Sohar International has kept pace with the evolving market needs by introducing relevant offers and promotions. The bank’s free remittance and salary transfer campaigns, as well as its discount offer with Qatar Airways, are excellent examples of such well-received initiatives, complementing customer lifestyles. With innovation driving the conceptualisation of new and enhanced products, Sohar International introduced an Instant Interest Fixed Deposit Account with competitive interest rates paid up-front, providing customers with a lucrative avenue to maximize savings. This approach has been extended to youth with the launch of the revamped Minor Account, offering a host of benefits, and encouraging savings for a better future. For its wealth management customers, Sohar International continues to grant personalised offerings, growing wealth based on customers’ investment appetite through a highly capable team operating nationwide.

Supporting customers to purchase property, as well as to leverage the national real estate sector, Sohar Islamic signed a memorandum of understanding with the Ministry of Housing and Urban Planning, enabling quick, easy, and convenient property financing solutions to the beneficiaries of the Naseem neighbourhood and other such communities that qualify for the Ministry’s Sorouh initiative. The Bank recognises the need to continually maintain direct engagement with customers as well as promote financial inclusion having revamped some of its key branches and introduced new branches such as the first Islamic banking branch in Khasab.

Community First

Weaving into the fabric of society through well-planned, and executed community-centric initiatives, Sohar International participated in meaningful contributions during Ramadan 2022 extending support via food rations and essential household equipment. The bank also demonstrated utmost promptness in leading action during times of crisis such as extending financial and hands-on support during Cyclone Shaheen and renovating houses of over 100 families within the impacted region.

Overall, Sohar International is strongly placed to become a formidable leader in Oman’s banking sector over the next couple of years.