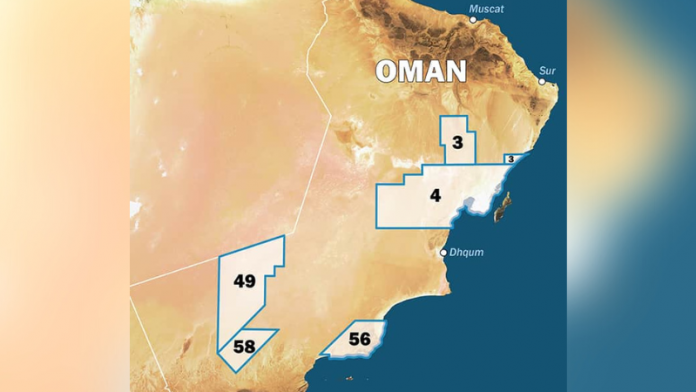

The appraisal programme on the Al Jumd discovery in Block 56 (onshore) in the Sultanate is continuing with the recent spud of the Al Jumd-3 well which is to be directly followed by Al Jumd-4, both of which are horizontal appraisal wells.

Revealed by Tethys Oil in a release on their Block 56 operations, it was mentioned that testing operations on the Sarha-3 and Sahab-1 wells had commenced with Sarha-3 flowing 20 barrels per day of high viscosity, 15 API oil from one section.

An appraisal well, in oil and gas nomenclature, is an exploration well drilled to establish the extent and size of a petroleum deposit that has already been discovered by a wildcat well.

By now, Block 56 has been operated by Tethys for just over a year, during which it has drilled five wells and acquired 2,000 km2 of high density, state-of-the-art 3D seismic.

The company expects the first oil from the long-term production test on Al Jumd in September 2022.

In the ‘Central Area’ of the Block, where the seismic was shot, the company are targeting close to 50mn barrels of gross unrisked prospective resources that are expected to begin drilling in 2023.

Magnus Nordin, Managing Director of Tethys Oil said in a public disclosure: “This is still reasonably early days. The first target, the Al Jumd discovery, is on its way to becoming the Al Jumd oil field but it is not quite there yet.”

He added that the appraisal results achieved from the first horizontal well, which had initial flows of 700 barrels per day when tested earlier this year, needed to be confirmed by the long-term testing of the well, as will the production potential of the recently completed Al Jumd-3 and Al Jumd-4 wells which have also delineated the structure.

All three wells are expected to be hooked up to the Early Production Testing systems before October 2022.

“Testing of the wells and their operating systems are expected to last for up to six months,” he said, before elucidating, “depending on results, additional wells may be drilled early next year when resource estimates will also be carried out.

“If all goes well, we may see the birth of the Al Jumd Oil Field during 2023.”

Sustained production from Block 56 would be a second production stream for Tethys in Oman.

The Managing Director further stated: “Exploration activities on Block 56 are set to gear up continually during the coming months and quarters. Testing of the Sarha-3 and Sahab-1 wells drilled during the quarter are ongoing and the results from these wells will give important information for the understanding of the greater Al Jumd area.

“But the big prize in Block 56 is the Central Area where the seismic acquired during the first quarter this year is now undergoing processing before interpretation will commence in earnest during the latter part of the fourth quarter.

“Older 2D seismic together with well data from earlier operators suggest the presence of several potential oil fields, which is for the 3D data to confirm or reject. If confirmed the drill bit will be deployed to make the final verdict. We expect to have completed the interpretation in the early part of the second quarter 2023.”

Block 56 remains a “smorgasbord of opportunity”, he was quoted as saying.

The Story Of Al Jumd

The Al Jumd-3 well is located 660 metres from Al Jumd-2 and will target the northeastern area of the Al Jumd structure with a horizontal section of at least 400 metres in the Al Khalata sandstone layer at a depth of 1,300 metres.

The Al Jumd-4 well is located about 700 metres from Al Jumd-2 and will appraise the southern area of the Al Jumd structure and, like Al Jumd-3, with a horizontal section of at least 400 metres in the Al Khalata sandstone.

The purpose of the two additional wells is to establish resource volumes and determine optimal well productivity levels.

The wells, as per a Tethys Oil statement, will be drilled with the same Schlumberger drilling rig 279 that was used to drill the three preceding wells on the Block earlier in 2022 and, like Al Jumd-2, both wells will be completed with a progressive cavity pump (PCP).

In 2020, the vertical Al Jumd-1 well flowed at a rate of 100 barrels of oil per day during testing while the horizontally drilled Al Jumd-2 flowed at an initial rate of 700 barrels per day when tested earlier this year.

Later in the third quarter of 2022, Al Jumd-3 and -4 together with Al Jumd-2 will undergo an extended well test.

Sarha-3 and Sahab-1

In the southwest of the Al Jumd area, testing operations of the exploration/appraisal wells Sarha-3 and Sahab-1 are currently in progress.

The testing of the first of three layers in the Sarha-3 well has reportedly been completed. The deepest layer, the Kareem sandstone formation, flowed, with a PCP, approximately 20 barrels per day of 15 API oil with high viscosity from a vertical section. Fluid samples and test data will be evaluated to determine the next steps.

In order to test the Al Khalata sandstone formation in Sarha-3, a workover rig is required, the sourcing of which is ongoing as per a Tethys Oil press release. Once testing of the Al Khalata is completed the shallower Gharif layer will be tested. The test plan includes both flow periods and shut-in periods to get a better understanding of reservoir properties and productivity. Once commenced, the testing process will take about three weeks per layer.

Testing of the exploration well Sahab-1 has also recently commenced. So far, the well has only flowed water as the well is cleaning up following significant mud losses during drilling. Testing and evaluation of these wells will continue throughout the third quarter of 2022.

Financial Success

Blocks 3&4 – two of Tethys Oil’s primary interest areas – have since 2011 produced more than 120mn barrels of oil and provided the company with over US$1bn worth of revenue.

The operations are still ongoing; albeit, Mr. Nordin stated that it was “not quite as strongly” as they had wished. Production for the second half of 2022 is expected to come close to what has been witnessed so far this year; meaning, an average for the year of around is expected to be 10,200 barrels per day.

This should still spell success for the company as oil prices hover around the US$100 per barrel per day mark.

During the quarter, after decisions at the AGM in May, Tethys Oil distributed over US$22mn to its owners.