Copper has become the new Green Metal owing to its importance in implementing and driving digital transformation as well as enabling legacy sectors. Peter Garnry, the Head of Equity Strategy at Saxo Bank, mines into how the element is aiding sustainable urbanisation.

The green transformation will electrify the global economy as cars go electric and more homes in colder areas will switch from natural gas as a heating source to that of air to water heat pumps. In warmer parts of the world, we will continue to see an acceleration in air conditioners to cool homes.

The main usage of refined copper is for electrical applications, but it is also used in housing (pipes and fittings), cars, telecommunication, and industrial machines. Copper has the second-highest thermal conductivity at room temperature among pure metals and is thus the preferred metal used in electrical applications.

As the world electrifies in the name of the green transformation and rapid urbanisation continues in Asia, Africa, and South America, copper will continue to enjoy strong annual growth rates.

How to get exposure to copper?

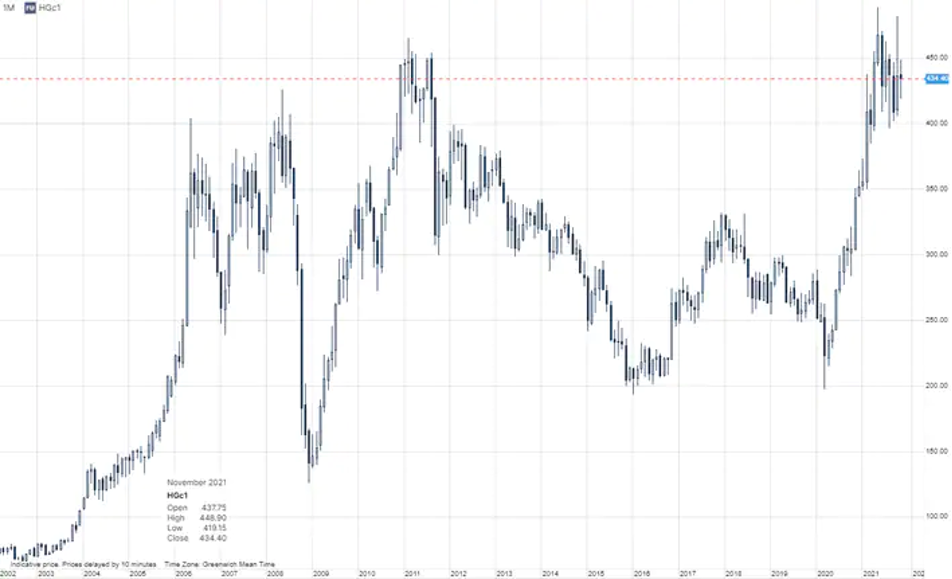

Copper has been rebranded as a green metal because of its importance for the green transformation and investors are increasingly asking us how to invest in copper. The most direct way is of course to invest in high-grade copper futures on COMEX (part of CME Group) with the current active contract being the Mar 2022 contract (Saxo ticker: HGH2), but the contract has a contract value of around US$106,537 at the current level making it inaccessible to most retail investors.

One could also invest through CFD on futures (Saxo ticker on Mar 2022 is COPPERUSMAR22) where the investor could buy 100 pounds of copper instead of 25,000 pounds in the futures reducing the contract size to US$425.

However, getting exposure through CFDs and futures the investor must regularly roll the contract to the next active contract, and the investor could also incur financing costs increasing the drag on performance. The chart below shows the continuous futures contract on high-grade copper since 2002.

Source: Saxo Group

Few miners offer pure exposure to copper

Another way to get exposure to copper that removes the difficulties of rolling futures or CFD contracts is to invest in mining companies that extract or refine copper. The table below shows 16 mining companies with exposure to copper with Codelco, the largest copper producer in the world, absent from the list as the Chilean miner is only listed in Chile and thus not investable for our clients.

The copper mining industry has delivered a median total return in USD of 132.6 per cent over the past five years beating the global equity up 105 per cent in the same period.

The rising copper prices the past year were driven by investors positioning themselves in green metals (defined as metals that will play a key role in the green transformation) which in turn has pushed up revenue in the industry by almost 40 per cent. Sell-side analysts are generally bullish on copper miners with a median upside of 16 per cent from current levels.

In our view, investors should select one or two copper miners to get exposure and avoid the ETFs on the industry as they are too broad-based and lack the pure exposure profile needed to play the copper market.

| Name | Market cap (USD mn) | F12M EV/EBITDA | Revenue growth (%) | Price-to-target (%) | 5Y return (USD) | Revenue from copper (%) |

| Antofagasta PLC | 18,871 | 5.1 | 43.8 | 3.4 | 166.6 | 84.8 |

| First Quantum Minerals Ltd | 14,962 | 5.1 | 41.9 | 20.9 | 111.3 | 84.2 |

| Southern Copper Corp | 45,944 | 8.6 | 39.7 | 3.1 | 128.9 | 81.6 |

| KGHM Polska Miedz SA | 7,026 | 3.8 | 28.3 | 26.4 | 80.0 | 73.8 |

| Jiangxi Copper Co Ltd | 9,843 | 7.2 | 44.6 | 37.8 | 27.3 | 71.0 |

| OZ Minerals Ltd | 6,397 | 7.6 | 38.7 | -6.1 | 288.4 | 60.0 |

| Glencore PLC * | 65,890 | 4.5 | -7.5 | 13.9 | 78.2 | 39.0 |

| Boliden AB | 9,291 | 5.1 | 26.2 | 3.7 | 68.1 | 35.0 |

| Freeport-McMoRan Inc | 57,080 | 5.7 | 55.5 | 13.2 | 193.3 | 33.7 |

| Teck Resources Ltd | 14,468 | 3.9 | 28.7 | 19.9 | 22.0 | 27.0 |

| BHP Group Ltd | 131,046 | 4.0 | 41.7 | 18.6 | 136.4 | 26.0 |

| Zijin Mining Group Co Ltd | 39,925 | 8.8 | 27.4 | 52.1 | 396.4 | 22.7 |

| Anglo American PLC | 47,342 | 3.5 | 59.0 | 15.7 | 262.8 | 22.3 |

| MMC Norilsk Nickel PJSC | 47,479 | 5.1 | 27.1 | 13.5 | 191.1 | 20.6 |

| Rio Tinto PLC | 98,497 | 3.6 | 39.5 | 15.8 | 149.2 | 11.5 |

| Vale SA | 60,329 | 2.5 | 77.2 | 87.6 | 111.4 | 5.5 |

| Aggregate / median | 674,389 | 5.1 | 39.6 | 15.7 | 132.6 | 34.4 |

Source: Bloomberg and Saxo Group

* EBITDA contribution as Glencore does not breakdown revenue split on metals

As the table also show, there is no such thing as pure exposure to copper except for futures, options and CFDs on the underlying copper. The miner with the highest revenue exposure to copper is Antofagasta with 84.8 per cent revenue share from copper extraction and refining.

Most copper miners also extract gold and silver as part of their copper operations. Out of the 16 copper miners in our list, only 6 of these miners have more than 50 per cent of revenue coming from copper extraction and refining.

Outlook and risks

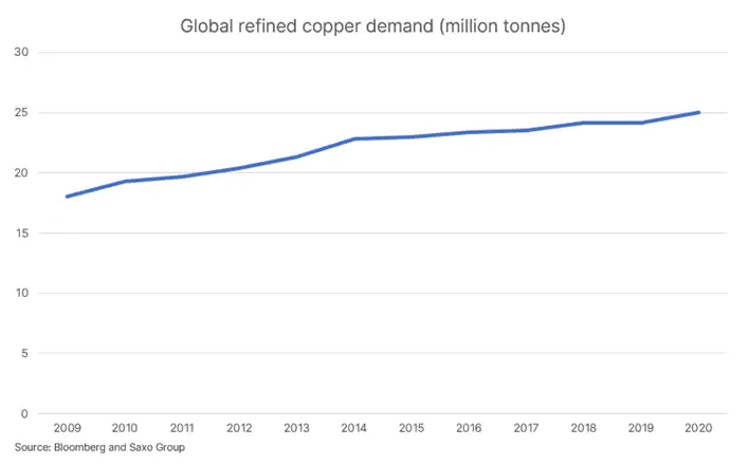

High-grade copper futures have been range trading for more than half a year as slowing demand out of China due to a slowdown in housing construction has weighed on the demand side. On the positive side, inventories have been tight in copper which has helped support the copper price and the global pipeline of new copper mines, but also potential tax charges in Chile and Peru (roughly around 40 per cent of global supply) could negatively impact supply and keep copper prices high. The annualised growth rate in global refined copper demand has been around 3 per cent in the period between 2009 and 2020.

China has for many years been the key driver of demand growth for copper but going forward electrification (electric vehicles and air-to-water heat pumps and urbanisation in India will begin to play a bigger marginal role on-demand creating a more steady and diversified demand picture.

In 2022, demand outside China will be driven by construction, grid infrastructure, and transport. Another risk to copper demand is significantly higher interest rates next year as that would curtail growth in construction which is interest rate sensitive.