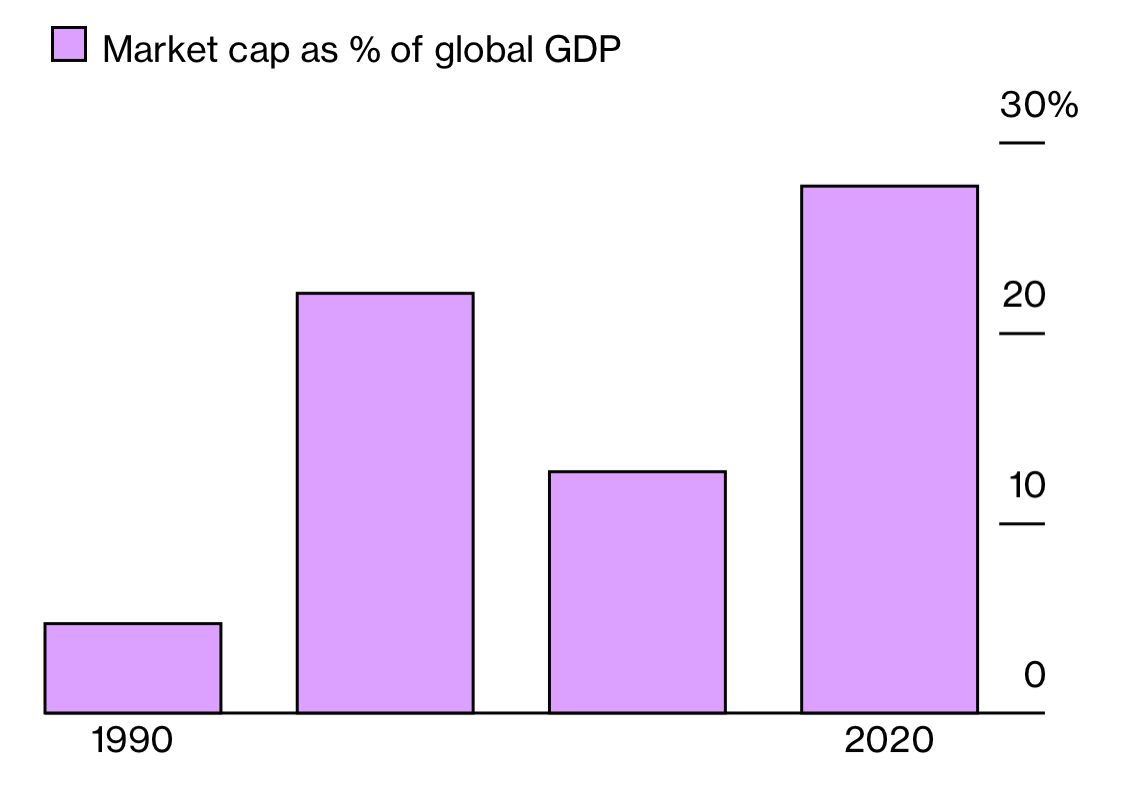

Prior to Covid-19, the world’s biggest companies were doing well. Now they are even better. The top 50 companies by value-added $4.5 trillion to their stock market capitalization in 2020, making their combined worth about 28% of global GDP.

That’s simply one degree of the way top companies have come to dominate the global economy, in a study conducted by Bloomberg Economics that maps out their converting role. The findings offer ammunition for key policymakers bent on reining withinside the giants—along with U.S. authorities that are looking to rally worldwide aid for better levies on company profits.

The benefits to superstar companies during the epidemic became even clearer, which is why the issue of how to control them has become a leap on the political agenda in many countries. Tech giants such as Amazon.com Inc. have business models designed for a one-year social distance, unlike mainstream competitors that rely on pedestrian traffic. And the government bailout worked best for large companies, benefiting from the central bank’s support, which kept borrowing costs low and share prices high. In contrast, Mosaic’s relief efforts for small businesses have left many struggling to pay their bills.

In the United States, President Joe Biden’s administration seeks to raise corporate taxes as part of a broader effort to tackle the long road to inequality. He wants to at least reverse some of the cuts made by his direct predecessor, Donald Trump. He is also pushing for a global tax deal that makes it harder for large companies to reduce their bills by shifting profits to lower tax havens. The practice spread with the growth of corporations.

A 2019 study by the International Monetary Fund found that up to 40 percent of what appears to be a foreign direct investment on paper is “phantom investment without substance in the corporate structure and which has nothing to do with the local economy.” It doesn’t matter. “

In a speech in April, Treasury Secretary Janet Yellen quoted the global “30-year competition for corporate tax rates.” He said the agreement between groups of 20 countries on global minimum tariffs would create “a more equal place of competition in the taxation of multinational corporations.” Push in the US is Apple Inc because of its low corporate tax rate. And Google owner Alphabet Inc.

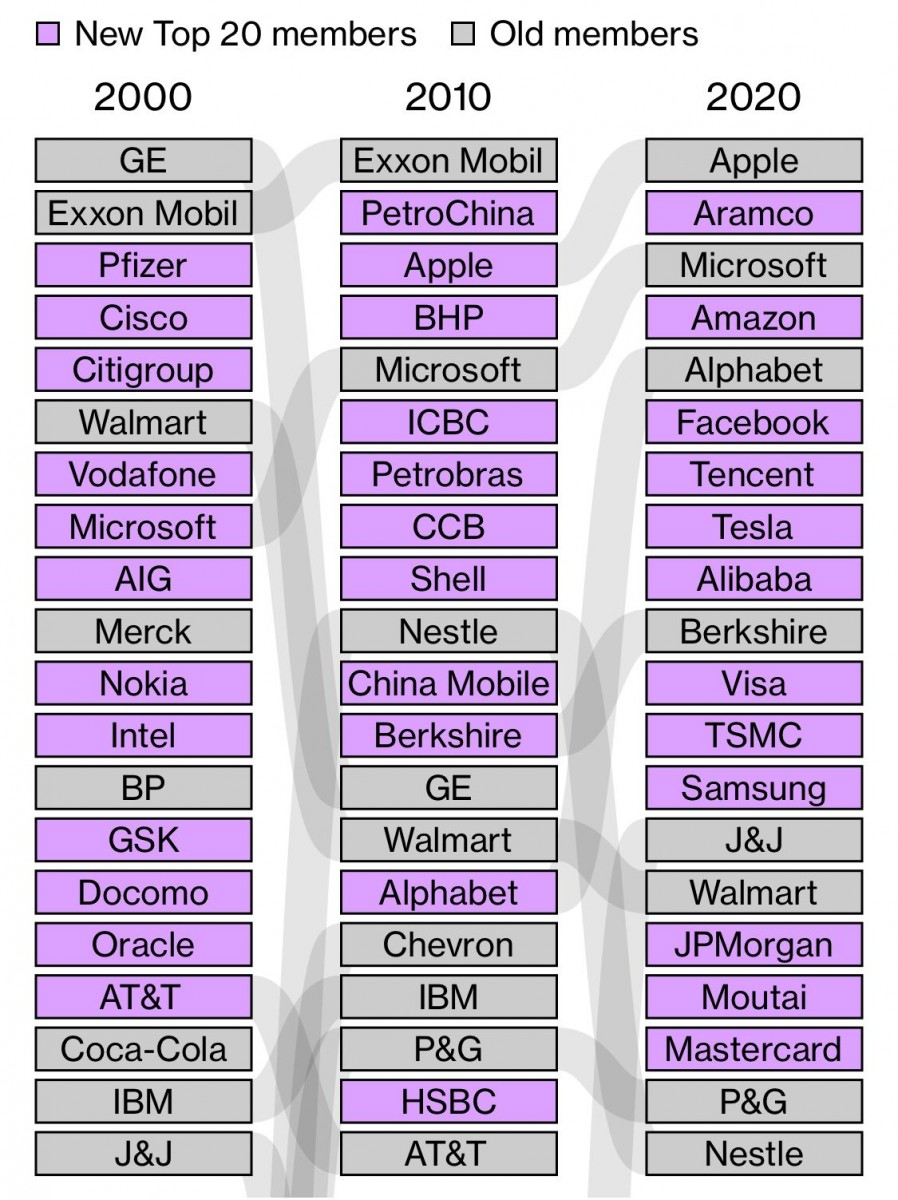

It is attracting resistance from countries such as Ireland, which encourages multinationals such as Ireland to set up regional headquarters. After the early signs that the United States wants a minimum rate of 21%, the Biden administration is now proposing 15%. This is a sign of consensus needed to reach consensus on controversial issues. In 1990, there were no Chinese companies in the top 50 exchange-traded funds.

Last year there were eight people. China’s profits came primarily at the expense of European companies, whose inventory presence declined from 15 to 7 during this period.

The Rise of China

The share of China has considerably gone up in the top 50 at the expense of Europe

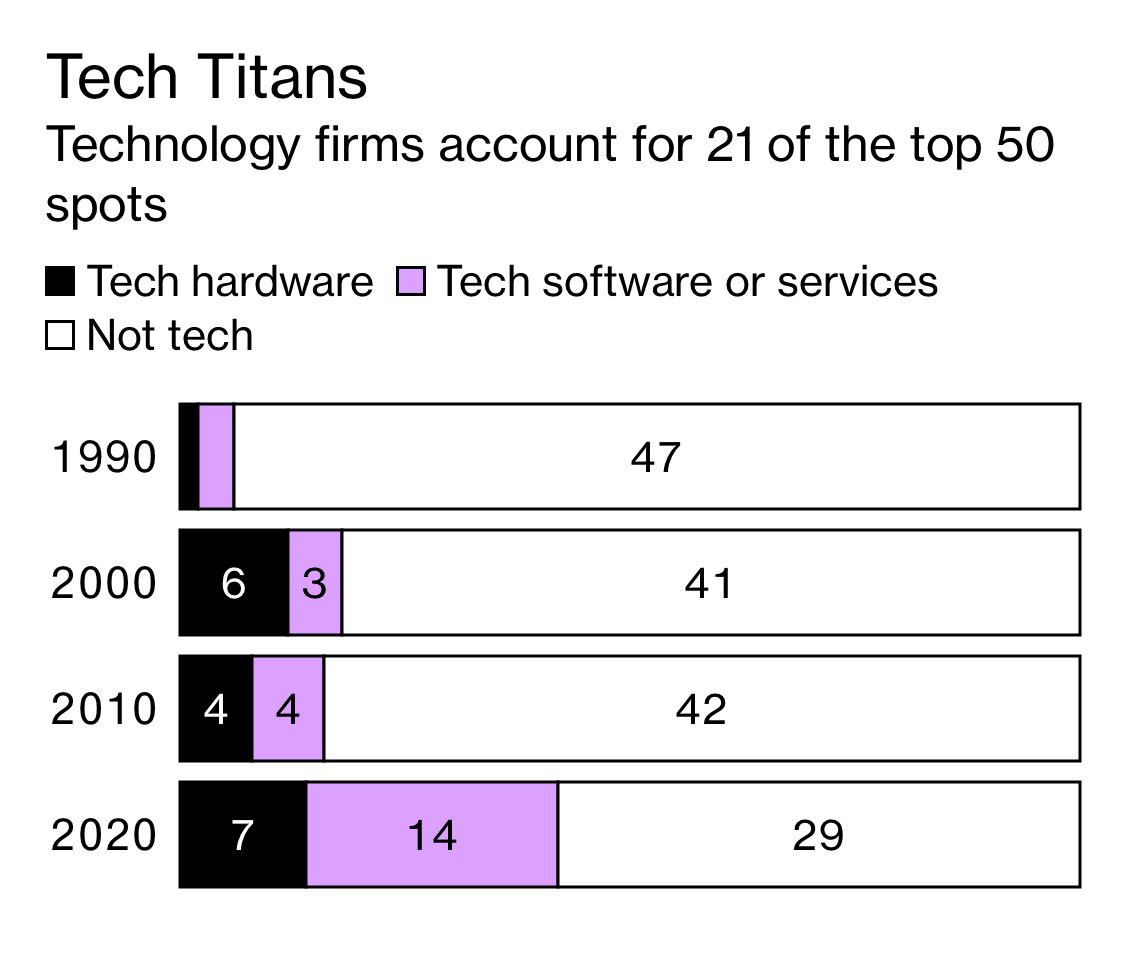

In addition to the changing geography of the global economy, Bloomberg Economics research also captures profound changes in the operations of the largest companies. Technology is at the top of the list and fossil fuel companies, with the exception of Saudi Arabia’s flagship Aramco, has declined.

Emerging Tech Titans

The tremendous growth of tech companies, in particular, has prompted government action. They are on the side of politicians and regulators almost everywhere. To do this, regulators blocked Jack Ma’s initial public offering from Ant Group, imposed record penalties on subsidiaries, including Alibaba Group Holding, and imposed record fines on other high-tech companies such as Tencent Holdings. China has expanded repression.

Europe is working on ways to tax companies like Amazon and Alphabet where they operate, rather than where they operate. The idea has caused tensions with the United States under Trump, but with the Biden team, an agreement is expected. In the United States, there is mutual support for a tougher approach to Big Tech, which is much higher than the tax rate.

This is an area where Biden appears ready to stick to his predecessor’s policies. The president has appointed Lena Khan, a professor at Columbia Law School and author of a landmark article accusing Amazon of a monopoly, to a key position in the Federal Trade Commission. The FTC is already trying to eliminate Facebook Inc. in a lawsuit filed under Trump, and the Justice Department has filed a monopoly lawsuit against Alphabet.

“Amazon has dominated by aggressively pursuing growth at the expense of profits,” Khan wrote in 2017, a strategy driven by the economics of the Internet platform market. “In this situation, predator pricing becomes overly rational.” Biden hired another Columbia University law professor, Tim Wu, for the Economic Council. Tim Wu’s 2018 book, The Curse of Beginning, calls for more aggressive use of antitrust law. The growing interest in the agenda was due to the trust of the United States more than a century ago when politicians led by Theodore Roosevelt dismantled the monopoly on oil, railroads, and other industries and replaced the corporate giants of the time. It depicts a comparison with the classical era. At that time, politicians from both parties were more radical and popular in a society suffering from wealth inequality if corporate wealth and power were concentrated to a non-democratic degree and this tendency could not be suppressed. I was worried that it could lead to demands. You can pave the way. And the sharp gap between urban and rural areas.”

Many of the concerns of governments are related to technology and its growing influence at all levels, including free speech and the immense amount of personal data that companies collect. But others are usually related to size, which creates bargaining power: the ability to outperform competitors, dominant suppliers, milk consumers, and shape control.

The increase in profit margins recorded by Bloomberg Economics is another measure of the rising power of superstar companies, which may expand if some companies do not sacrifice their short-term earnings for market share gains.

In the coming years, Economists who study the problem of excellence have concluded that it appears in the bottom 50 of the world. For example, a 2018 study found that three-quarters of US industries have experienced an increase in concentration over the past two decades, with the market dominated by fewer and larger companies.

With big profits, small tax payments, and limited capital or even labor requirements, the new generation of mega-corporations also poses challenges for monetary and fiscal policy.

The supply-side argument that lower taxes will drive growth through recruitment and investment – never particularly backed by the data – looks even weaker now. And the idea that central banks can achieve the same effect with lower interest rates fails when mega-corporations have amassed so much money that they no longer need credit. In 2020, the top 50 companies had a pile of $ 1.8 trillion in cash, enough to fund more than five times their capital expenditures in a year.

Among all the concerns raised by the rise of superstar companies, Bloomberg economics research probably provides a more reassuring finding. Over the last 30 years, about half of the top 50 rankings have been exchanged.

China’s rise, technological advances, and clean energy revolution drive global corporate rankings (See image below)

Image and data source: Bloomberg Businessweek