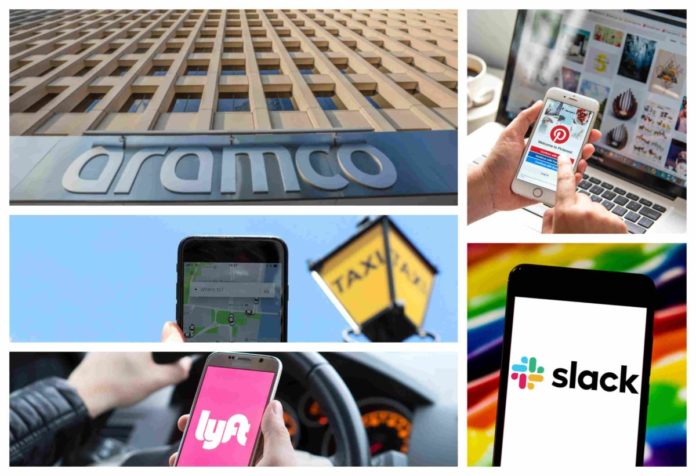

It has been a rough ride for companies that debuted on the stock exchanges this year, with high valuations and high expectation. From Uber to Slack to Lyft. But some have weathered market scrutiny well and have been rewarded, like Saudi Aramco. Here is a list of the biggest initial public offerings (IPOs) of 2019– from the smallest to the largest.

Pinterest Inc (PINS)

IPO date: April 18

Exchange: NYSE

Offer price: $19 per share

Current price: $18.21 (Dec 16)

IPO valuation: $10 billion

Current market cap: $10.17 billion

The stock of the social media company is on a downhill path – falling to below $20 after peaking to $30, given its revenue growth rate slipping. But analysts remain bullish on the stock.

Slack Technologies Inc (WORK)

IPO launch: June 20

Exchange: NYSE

Reference price: $26 per share

Current price: $21.41 per share (Dec 16)

Listing valuation: $15.7 billion

Current market cap: 11.7 billion

Slack went for a direct listing instead of an IPO but the best does not seem to have paid off so far, with the stock consistently losing its value – from trading at $3.62 on opening day to now selling at way below the reference price. Slack is still red territory in terms of net gross margins.

Uber Technologies (UBER)

IPO launch: May 10

Exchange: New York Stock Exchange

Offer price: $45 per share

Current price: $30.5 (Dec 16)

IPO valuation: $82.4 billion

Current market cap: $51.26 billion

It was one of the biggest IPOs of the year under new CEO Dara Khosrowshahi but the stock price has over the last seven months proved to be a roller coaster. Uber began trading below the offer price of $41.57 on May 10, rose to the high of $46.38 and has been falling ever since.

Read: Two Expected 2020 IPOs Bring Hope to Egypt’s Subdued Market

Lyft Inc (LYFT)

IPO date: March 29

Exchange: NASDAQ

Offer price: $72 per share

Current price: $47.93 (Dec 16)

IPO valuation: $24 billion

Current market cap: $14.2 billion

Lyft’s share price has had a better fate that rival Uber’s even though the stock never recovered from the high of $78.29 that it traded on day one back in March. Analysts are now worried is the company is not making as much profit as expected and offer mixed outlook for the stock 2020.

Saudi Aramco (2222.SE)

IPO launch: Dec 11

Exchange: Tawadul

IPO price: 32 riyals

Current price: 37.8 riyals (Dec 17)

Listing valuation: $1.7 trillion

Said to be the biggest IPO ever, the world’s biggest oil company has had a blockbuster listing so far, touching a valuation of $2 trillion just a few days after going public, since remains one of the most profitable corporations ever.