(Bloomberg) — Samba Financial Group jumped in Saudi Arabia after rival National Commercial Bank, the kingdom’s largest lender by assets, offered to acquire it for as much as $15.6 billion.

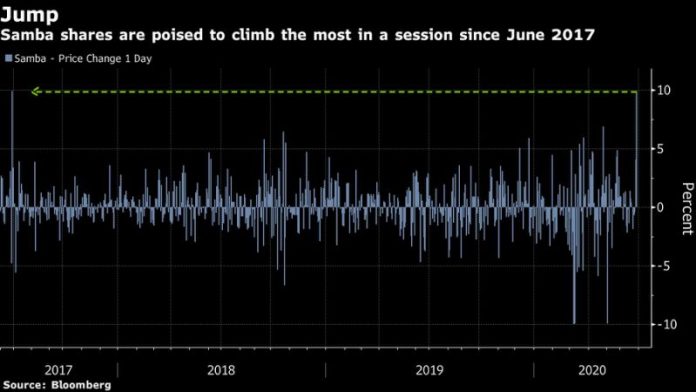

The shares advanced 9.9% to 26.30 riyals in Riyadh on Sunday, while National Commercial Bank rose 5%. Last week, National Commercial Bank proposed paying as much as 29.32 riyals per share for Samba, a premium of about 27.5% to its closing price on Wednesday.

Saudi Arabia has been taking steps to shore up its banking sector from the double whammy of the coronavirus shock and lower oil prices. Lenders in the world’s largest oil exporter are expected to be hit hard as lockdown measures and lower spending impact earnings.

The country’s Public Investment Fund is the major shareholder in both lenders, with a 44.3% stake in National Commercial Bank and 22.9% of Samba. The combined entity would have assets of about $210 billion, making it the third-largest in the Middle East behind Qatar National Bank QPSC and First Abu Dhabi Bank PJSC, according to data compiled by Bloomberg.

Here’s what analysts are saying about the deal:

- EFG-Hermes says the transaction appears to be at a “pretty advanced” stage and that the valuation is fair

- “If you have a common shareholder that always makes things easier, and I think that is one of the reasons this deal was announced,” analyst Shabbir Malik said in a telephone interview

- “In some ways the two banks are complementary. In terms of capital, Samba has a very strong capital position, so that can be beneficial to the merged entity. Liquidity-wise, both banks are very good. In terms of CASA funding, NCB is stronger than Samba”

- “Samba can lift its profile, lift its profitability, at a much faster pace than it would have been able to do it by itself”

- CI Capital says the deal gives NCB “additional market share in the corporate” business and “gives it more capacity to compete inside and outside of the kingdom”

- “We’re very happy to see a swap ratio right at the very beginning, it never happened before,” said Sara Boutros, senior analyst of real estate and financials, in a telephone interview

- “Operationally, we thought Riyad Bank made more sense, because Riyad would’ve given NCB the push it needed in the retail space.” Still, valuation for Samba is “very reasonable, we’re very positive on the pricing”

- Credit Suisse’s Ahmed Badr, head of Middle East and North Africa equities, said there is a need for consolidation within Saudi Arabia, and the deal could create “a national champion”

- “Saudi has a long-term infrastructure plan and you need a national champion to be the lender for that,” he said in an interview with Bloomberg TV

- “The question is whether NCB is going to be able to better efficiently utilize Samba’s balance sheet to deliver high ROEs”

- SICO BSC considers the valuation “to be fair, considering Samba is an under-leveraged bank with a fairly clean balance sheet,” according to Chiro Ghosh, vice president for financial institutions

- “The large equity book size, would present an inherent advantage in lending to large corporations. We also expect the merged entity to next target regional projects.”

- “The merged entity would have a healthy diversity, with a strong presence in consumer and reasonable international operations through NCB, while Samba would provide strong corporate sector presence”

- Citigroup Inc. upgraded Samba shares to buy after the announcement, citing “multiple levers to synergies”

- Analysts Rahul Bajaj and Ronit Ghose expect a 3%-6% accretion for NCB shareholders by 2023, with the return on tangible equity for the combined entity of 15% by 2023

- Pro-forma valuation for the merged business generates fair value of 175 billion riyals ($46.7 billion)

- Citigroup increased the price target for Samba to 30 riyals from 23 riyals

Read more:

- Saudi Bank NCB Plans $15.6 Billion Takeover of Rival Samba

- Middle East Inks $25 Billion of Deals Defying Virus Gloom

- Arabian Gulf Dealmaking Surges in Move Away From Oil: Chart