Banks in Oman recorded a significant growth in profits and credit disbursement during the financial year 2022 reflecting the strong fundamentals of Oman’s economy.

An OER – UNITED SECURITIES Survey | Verified by Abu Timam Grant Thornton

Oman’s banking sector is poised to grow stronger as the total net profits of Omani banks listed on the Muscat Stock Exchange (MSX) jumped by 20.6 per cent to RO409mn for the full year 2022 as compared to RO338.9mn net profits reported in 2021.

Preliminary financial results recently announced by the listed banks on the Muscat Stock Exchange showed an increase in profits of all the banks and a rise in their various financial indicators. The sharp rise in banking sector profits reflects the state of recovery of the Omani economy from the Covid-19 pandemic as well as the government’s efforts to mitigate the effects of the pandemic on various economic activities.

The banks’ improved financial results also reflect the efforts made by banks to diversify their lending and financing portfolios and their contributions to financing projects implemented by the government and the private sector.

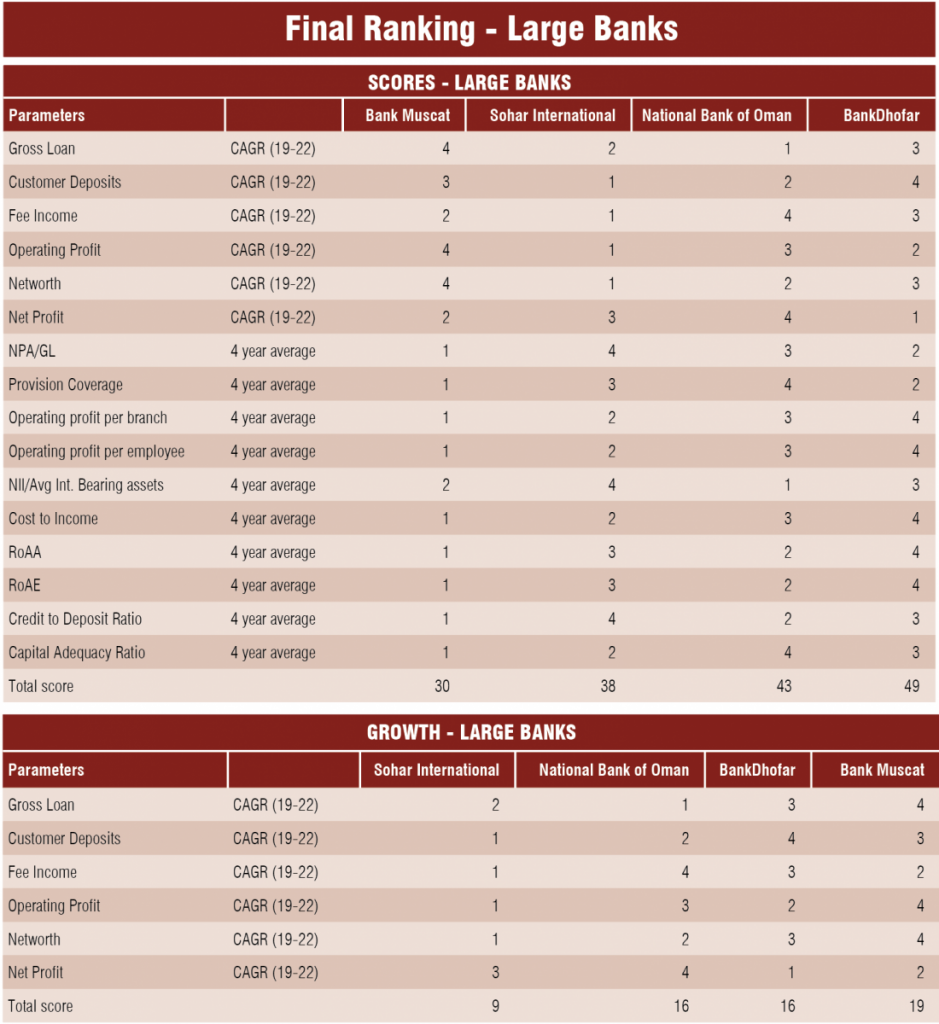

Bank Muscat posted the highest profit at RO200.7mn in 2022 compared to RO189.6mn in the previous year. However, the 5.9 per cent year-on-year growth in net profit recorded by Bank Muscat was the lowest growth among all the banks. National Bank of Oman (NBO) ranked second with its 2022 net profit amounting to RO48.2mn compared to RO30.3mn in the previous year, recording an increase of 59.2 per cent.

Sohar International Bank came in third place recording a net profit of about RO34.9mn in 2022 compared to RO28.3mn in 2021, an increase of 23 per cent. BankDhofar’s net profit rose by 36 per cent to RO34.1mn last year as compared to RO25.1mn reported in 2021. Net profit of HSBC Bank Oman increased from RO18.3mn in 2021 to RO26.7mn in 2022, recording a robust growth of 45.9 per cent. Oman Arab Bank’s net profit surged by more than 128 per cent to RO16.2mn in 2022 compared to RO7.1mn reported in the previous year, recording the highest growth in the banking sector in 2022.

Ahlibank’s net profit grew by 19.8 per cent to RO33.1mn in 2022 compared to RO27.6mn recorded in the previous year. Fully-fledged Islamic bank Bank Nizwa was able to increase its net profit in 2022 to RO15mn compared to RO12.5mn in 2021, recording an increase of 20 per cent.

Omani banks’ preliminary financial statements indicated that the total assets of the banks increased to RO35.990bn as of December 31, 2022, registering an increase of about RO90mn over the levels recorded at the end of 2021.

All banks recorded an increase in their total assets during the past year, except for Bank Muscat, whose assets declined from about RO13.1bn to RO12.7bn, recording a decrease of 2.3 per cent. Bank Muscat accounted for 49 per cent of the total net profits recorded by all banks during the last year and it accounted for 35.4 per cent of the total assets of the banks listed on the Muscat Stock Exchange.

Credit growth

The banking sector recorded a year-on-year credit growth of 4.8 per cent in 2022 but deposit growth sharply slowed to 1.1 per cent in 2022, the latest data from the Central Bank of Oman showed. Total outstanding credit extended by the banking sector (both conventional and Islamic banks) grew 4.8 per cent to RO29.2bn at the end of December 2022 against the same month of the previous year according to the Central Bank of Oman.

Of the total outstanding credit, bank credit to the private sector demonstrated a growth of 4.1 per cent year-on-year to reach RO24.4bn. non-financial corporations received the highest shares of the total private sector credit, at approximately 45.8 per cent in end-December 2022, followed by the household sector at 45.1 per cent.

The share of financial corporations was 5.3 per cent in total private sector credit, while other sectors received the remaining 3.7 per cent as of end-December 2022. Conventional banks’ total outstanding credit grew 3.4 per cent year-on-year in December 2022. While conventional banks’ credit to the private sector increased 1.9 per cent to RO19.5bn, their overall investments in securities declined by 11.5 per cent to RO4.3bn, the CBO data showed.

Banks’ investment in government development bonds marginally decreased by 0.5 per cent year-on-year to RO2.2bn in December 2022, while their investments in foreign securities increased by 1.4 per cent to RO0.9bn over the same period.

On the other hand, total banking sector deposits in Oman grew by a lower rate of 1.1 per cent to RO25.9bn at the end of December 2022 against the same period a year ago. Total private sector deposits slightly decreased by 0.3 per cent to RO17.4bn. In terms of the sector-wise composition of private sector deposits, the biggest contribution was from household deposits at 52.2 per cent, followed by non-financial corporations at 28.9 per cent, financial corporations at 16.1 per cent and other sectors at 2.9 per cent.

Aggregate deposits held with conventional banks decreased 0.9 per cent year-on-year to RO21bn in end-December 2022. Private sector deposits, which accounted for 67.8 per cent of total deposits with conventional banks, decreased by 2.0 per cent as of December 2022 to reach RO14.3bn.

Moreover, government deposits with conventional banks witnessed an increase of 2.8 per cent at RO4.9bn and deposits of public enterprises increased by 2.9 per cent to RO1.4bn. As per the CBO data, the weighted average interest rate on Omani rial deposits with conventional banks witnessed an increase from 1.976 per cent in end-December 2021 to 1.993 per cent at end-December 2022. The weighted average Omani rial lending rate decreased from 5.570 per cent to 5.379 per cent over the same period.

Meanwhile, the overnight Omani rial domestic interbank lending rate jumped to 3.944 per cent in December 2022 from 0.369 per cent a year ago. This is an outcome of the increase in the average repo rate for liquidity injection by the CBO to 4.774 per cent from 0.5 per cent a year ago, moving with the US Federal Reserve rate, the central bank said.

Islamic financing

Oman’s Islamic banking sector continued to witness robust growth in 2022, recording double-digit growth in both credit and deposits. Islamic banking entities provided financing worth RO5.4bn at the end of December 2022, recording a growth of 12.2 per cent over that a year ago. Total deposits held with Islamic banks and windows increased by 10.9 per cent to RO4.9bn.

Total assets of Islamic banks and windows increased by 8.7 per cent on a year-on-year basis to reach RO6.4bn at the end of December 2022. Islamic assets now constitute about 16.5 per cent of the total banking system assets in Oman as of the end-December 2022.

Omani banks’ reasonable credit fundamentals and improved operating conditions will support lending growth and profitability in 2023, according to global credit rating agency Fitch Ratings. In a recent report, Fitch noted that Omani banks emerged from the Covid-19 pandemic with reasonable credit fundamentals which place the sector in a good position for improving profitability in 2023.

Fitch said that Oman’s high oil revenues will continue to support economic activity and drive business generation for the sultanate’s banks. The rating agency expects a credit growth of 4.0 per cent in 2023, underpinned by high oil prices, healthy economic growth, a low inflationary environment, and positive employment prospects.

Fitch revised the outlook on Omani banks’ operating environment factor score to ‘positive’ from ‘stable’ to reflect improved operating conditions, as well as the recent revision of the outlook on the sultanate’s sovereign rating to ‘positive’ from ‘stable’.