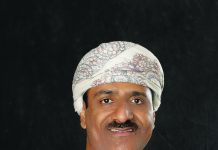

BankDhofar achieved remarkable growth in the year 2018, as reflected in its consolidated net profit, capital adequacy ratio and total assets. Excerpts from an interview with CEO, Abdul Hakeem Al Ojaili

How was BankDhofar’s financial performance in FY2018?

Despite the current challenging economic and financial situation driven by volatile oil prices and rising interest rates, BankDhofar continued to grow in net profit in 2018, achieving 5.57 per cent growth year-on-year from RO47.63mn as of December 31, 2017 to RO50.28mn as of December 31, 2018. In continuation of our capital augmentation to strengthen the capital base, we have successfully raised capital of RO95mn in forms of rights issue of ordinary shares (by RO55mn) and additional tier 1 perpetual bond of RO40mn.

What were the major milestones during the year? Can you talk about the measures to enhance retailing, ATM and CDM networks of the bank?

Although we are continuously improving and boosting our competitiveness across all business lines and segments, BankDhofar has achieved remarkable growth in the past year and that applies to consolidated net profit, capital adequacy ratio and total assets. Moreover, as we are working towards providing best customer experience to our customers, and we are focusing more on digital banking which has been a tremendous success since we revamped our digital banking platforms such as mobile banking, internet banking, the vast network of ATMs and CDMs, as well as multi-function kiosks that we recently introduced to serve our customers. All these platforms are available for BankDhofar customers 24/7 and they easily accessible to everyone anywhere. We constantly and continuously aim to lead the financial market in Oman by providing best customer experience through state-of-the-art technology and implementation of cutting-edge e-banking solutions; hence, we have received a number of prestigious awards from local and international institutions in recognition of such efforts and initiatives.

What about the measures taken to support SMEs?

Understanding the key role of SMEs in a sustainable and vibrant economy, we have formulated a number of strategic initiatives to further boost and contribute to the development of the SMEs sector across Oman. This comes in line with the requirement to increase SMEs participation in the Sultanate’s Gross Domestic Product (GDP) through various governmental initiatives. In tune with such national direction, BankDhofar has a dedicated department that caters to the specific needs and requirements of our SME customers. A team of dedicated business relationship managers are deployed to provide appropriate financing solutions to the entrepreneurs in the SME segment. Moreover, we are extending our services to this segment by spreading out delivery channels and leveraging cutting-edge technology in the banking and finance industry in order to reach out to our customers across the country. In the coming years the focus on this segment will be in line with government initiatives and the Bank’s endeavour to play an active role in the promotion, development and financing of SME sector in the Sultanate.

What were the major HR initiatives taken by the bank?

To achieve our vision to be the Best Bank in the Gulf, we have aligned our human resources strategy and objectives by implementing our #Together2020 Transformation Journey with a clear roadmap in terms of objectives, strategy, programmes and projects. We firmly believe that people are the biggest differentiator in our transformation journey which can be achieved by having committed, engaged and motivated talents who will continue driving sustained business performance. This has been recognised locally, regionally and internationally by winning a number of prestigious awards. Our HR team is currently driving the development of Performance Culture which is a key pillars of the #Together2020 Transformation Journey, through the various HR transformation initiatives. We have also continued our strategy to recruit and retain critical talents by providing them with career development opportunities, competitive rewards and recognition programmes, and implementing learning and development programmes that will enable them to achieve their maximum potential. We have successfully recruited 142 new staff this year including 95 fresh graduates through Ruwad BankDhofar Programme and they have undergone an intensive training and development programme in all areas related to banking and professional development. Having said that, we proudly maintained an Omanisation level of over 93.4 per cent and also retained critical talent by achieving a single digit attrition rate.

What are the future plans to enhance operational efficiency and technological deployment?

For more than two decades, BankDhofar has been building a reputation for its foresight and reliable growth. As one of the largest banks in Oman, BankDhofar already claims a lion’s share of the market and continues to steadily grow. Innovation drives the bank’s prosperity and expansion, and our customer-centric focus ensures that we keep a finger on the pulse on the evolving needs of our customers. The latest tech advances are seamlessly integrated into our digital banking services, providing instant access and convenient controls for all customers, from individual accountholders to corporate customers. Our team references data-backed evidence to tailor products and services to match the technical needs and requirements of the customers. Some of the major technology initiatives we launched in 2018 include an upgrade of cards switch with several enhancements including point of sale (POS) processing capabilities, implementation of the new integrated business process management platform iBPMS, new call centre Interactive Voice Response (IVR) system, new credit process automation as well as a number of technology infrastructure upgrades. We have also implemented additional security features in ATMs and CDMs, and introduced alternate delivery channels such as Tasdeed online bill payments, 3D touch features, credit loyalty rewards inquiry through the bank’s award-winning mobile banking application. In 2018, BankDhofar became the first bank from Oman to join the Blockchain consortium bank chain, a consortium of global banks for exploring, building and implementing Blockchain solutions.

What’s are the bank’s priority areas and outlook for 2019?

With the vision to be the best bank in the Gulf, we have set a clear roadmap for BankDhofar to be recognised as the best bank in the Gulf in terms of customer experience. Our comprehensive transformation journey stresses on investing in people, technology, processes and infrastructure to enable us to offer a distinguished experience to customers. I envision us as the preferred banking services provider because we are able to meet our customers’ needs in a fast, error-free and personal manner.

2016 marks the year during which our #Together2020 transformation journey commenced. Since then, we were able to design and execute multiple initiatives of which many have now come to fruition. Our journey is designed with equal focus on internal and external factors. That means while we introduce innovative products and service models, we are simultaneously building our team’s capabilities and empowering them. Since this journey started, we have inaugurated BankDhofar Academy to be the vehicle through which we build our people capabilities in line with our vision. We have opened our one-stop-shop corporate centre located strategically to efficiently serve our corporate clients. We also realise and embrace the importance of digital banking spanning across multiple segment, and we have been recognised for such initiatives locally and internationally.